Dental Treatment costs & Finance Options

We appreciate that the cost of treatment is an important consideration…

Dental Treatment costs & Finance Options

We appreciate that the cost of treatment is an important consideration…

You are unique, your treatment will be too

For some, dental treatment can appear to be an expensive luxury but you only get one set of adult teeth and you use them every day. Looking at it this way you can see why Specialist dental treatment is an investment that you will benefit from for the rest of your life. Costs will vary depending on the treatment you need. Some people may only need minor corrections to their teeth, while others may require more significant work.

At Bristol Dental Specialists, we want to make treatment an option for everyone. That is why we are committed to keeping our treatments affordable. To help with this, we offer a wide range of interest-free and interest-bearing plans to our patients.

We can help provide you with a simple and affordable way to pay for all types of dental treatment. A range of 0% APR and low-interest funding options are available through our patient finance provider, enabling you to get the treatment you want at a price to suit your pocket.

Patient finance is subject to age and status, minimum spend applies. We will discuss the options at your consultation to find the most suitable payment plan for you.

Calculating your treatment cost

When you visit us for your initial consultation or Smile Assessment, scans are taken and a full examination is carried out that help us understand what condition or combination of conditions you currently have. We will then recommend how these need to be addressed to achieve the outcome you want. Your cost of treatment is then based on your preferred choice and budget in order to achieve the best possible outcome.

Calculating your treatment cost

When you visit us for your initial consultation or Smile Assessment, scans are taken and a full examination is carried out that help us understand what condition or combination of conditions you currently have. We will then recommend how these need to be addressed to achieve the outcome you want. Your cost of treatment is then based on your preferred choice and budget in order to achieve the best possible outcome.

0% APR Finance

Treatment fees can be paid with an initial deposit at the beginning of treatment followed by interest-free monthly payments typically over the course of one year. If you prefer to extend this payback period, we do also offer an interest-charging finance plan with a third party credit company.

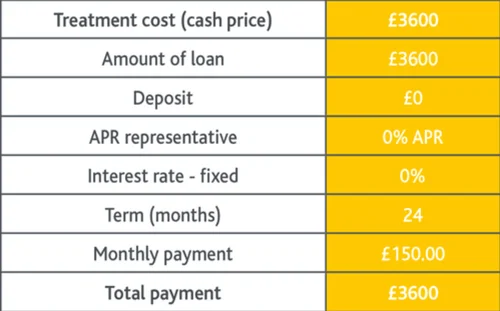

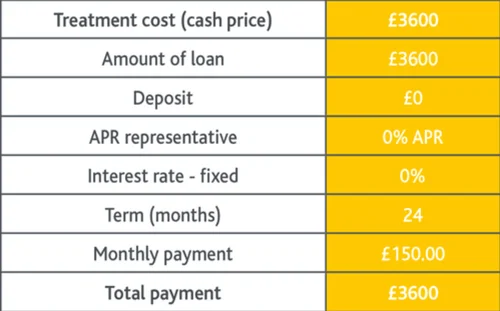

0% APR REPRESENTATIVE EXAMPLE

Bristol Dental Specialists, 24 Berkeley Square, Bristol, Gloucestershire, BS8 1HP. Telephone 0117 450 6666. Bristol Dental Specialists Ltd trading as Bristol Dental Specialists is a credit broker not a lender and is authorised and regulated by the Financial Conduct Authority, 914167. Registered in England & Wales 11696017. Registered Address: 24 Berkeley Square, Bristol, Gloucestershire, BS8 1HP.

Where required by law, loans will be regulated by the Financial Conduct Authority and the Consumer Credit Act 1974.

Medenta Finance Limited, authorised and regulated by the Financial Conduct Authority No: 715523. Registered in Scotland, No: SC276679. Registered address: 50 Lothian Road, Festival Square, Edinburgh, EH3 9WJ. Tel: 01691 684175. Medenta act as a credit broker, not the lender and will introduce businesses to V12 Retail Finance Limited for which they will receive a commission. The amount of commission will vary depending on the product chosen and amount borrowed.V12 Retail Finance Limited is authorised and regulated by the Financial Conduct Authority. Registration number: 679653. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH. Correspondence address: 25-26 Neptune Court, Vanguard Way, Cardiff, CF24 5PJ.

V12 Retail Finance Limited act as a credit broker, not a lender, and only offers credit products from Secure Trust Bank PLC for which they will receive a commission, the amount will vary depending on the amount of credit taken out but will not vary depending on the product chosen. Secure Trust Bank PLC trading as V12 Retail Finance is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number: 204550. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH.

Terms and conditions apply. Written quotations are available on request from Secure Trust Bank PLC. Credit facilities are subject to status and affordability checks and only available to UK residents over the age of 18. Secure Trust Bank PLC reserves the right to decline any application. APR and repayment details are correct at time of publish.

Telephone calls are recorded for training and compliance purposes.

0% APR Finance

Treatment fees can be paid with an initial deposit at the beginning of treatment followed by interest-free monthly payments typically over the course of one year. If you prefer to extend this payback period, we do also offer an interest-charging finance plan with a third party credit company.

0% APR REPRESENTATIVE EXAMPLE

Bristol Dental Specialists, 24 Berkeley Square, Bristol, Gloucestershire, BS8 1HP. Telephone 0117 450 6666. Bristol Dental Specialists Ltd trading as Bristol Dental Specialists is a credit broker not a lender and is authorised and regulated by the Financial Conduct Authority, 914167. Registered in England & Wales 11696017. Registered Address: 24 Berkeley Square, Bristol, Gloucestershire, BS8 1HP.

Where required by law, loans will be regulated by the Financial Conduct Authority and the Consumer Credit Act 1974.

Medenta Finance Limited, authorised and regulated by the Financial Conduct Authority No: 715523. Registered in Scotland, No: SC276679. Registered address: 50 Lothian Road, Festival Square, Edinburgh, EH3 9WJ. Tel: 01691 684175. Medenta act as a credit broker, not the lender and will introduce businesses to V12 Retail Finance Limited for which they will receive a commission. The amount of commission will vary depending on the product chosen and amount borrowed.V12 Retail Finance Limited is authorised and regulated by the Financial Conduct Authority. Registration number: 679653. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH. Correspondence address: 25-26 Neptune Court, Vanguard Way, Cardiff, CF24 5PJ.

V12 Retail Finance Limited act as a credit broker, not a lender, and only offers credit products from Secure Trust Bank PLC for which they will receive a commission, the amount will vary depending on the amount of credit taken out but will not vary depending on the product chosen. Secure Trust Bank PLC trading as V12 Retail Finance is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number: 204550. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH.

Terms and conditions apply. Written quotations are available on request from Secure Trust Bank PLC. Credit facilities are subject to status and affordability checks and only available to UK residents over the age of 18. Secure Trust Bank PLC reserves the right to decline any application. APR and repayment details are correct at time of publish.

Telephone calls are recorded for training and compliance purposes.

Do I qualify?

Loans are approved subject to status and the following minimum criteria:

Aged over 18 or below 80

Employed, Pensioner, Registered Disabled, Self Employed

Income of £10,000 per annum or more

Debit or Credit Card Holder

Bank Account which can process Direct Debit payments

At least 3 years of permanent UK address history

Do I qualify?

Loans are approved subject to status and the following minimum criteria:

Aged over 18 or below 80

Employed, Pensioner, Registered Disabled, Self Employed

Income of £10,000 per annum or more

Debit or Credit Card Holder

Bank Account which can process Direct Debit payments

At least 3 years of permanent UK address history

Consultations

Non-clinical consultation with treatment care co-ordinator FREE

Clinical consultation with specialist £150

Clinical consultation – Implant £280

Clinical consultation – Paediatric £225

Consultations

Non-clinical consultation with treatment care co-ordinator FREE

Clinical consultation with specialist £150

Clinical consultation – Implant £280

Clinical consultation – Paediatric £225

Opening Hours

Monday 8.00am – 7.00pm

Tuesday 8.00am – 7.00pm

Wednesday 8.00am – 7.00pm

Thursday 8.00am – 7.00pm

Friday 8.00am – 5.00pm

Saturday By arrangement only

Sunday Closed

Bristol Dental Specialists Ltd Registered in England & Wales company number 11696017

Bristol Dental Specialists, 24 Berkeley Square, Bristol, Gloucestershire, BS8 1HP. Telephone 0117 450 6666. Bristol Dental Specialists Ltd trading as Bristol Dental Specialists is a credit broker not a lender and is authorised and regulated by the Financial Conduct Authority, 914167. Registered in England & Wales 11696017. Registered Address: 24 Berkeley Square, Bristol, Gloucestershire, BS8 1HP.

© Copyright Bristol Dental Specialists 2020-24 | Website by QualiConvert